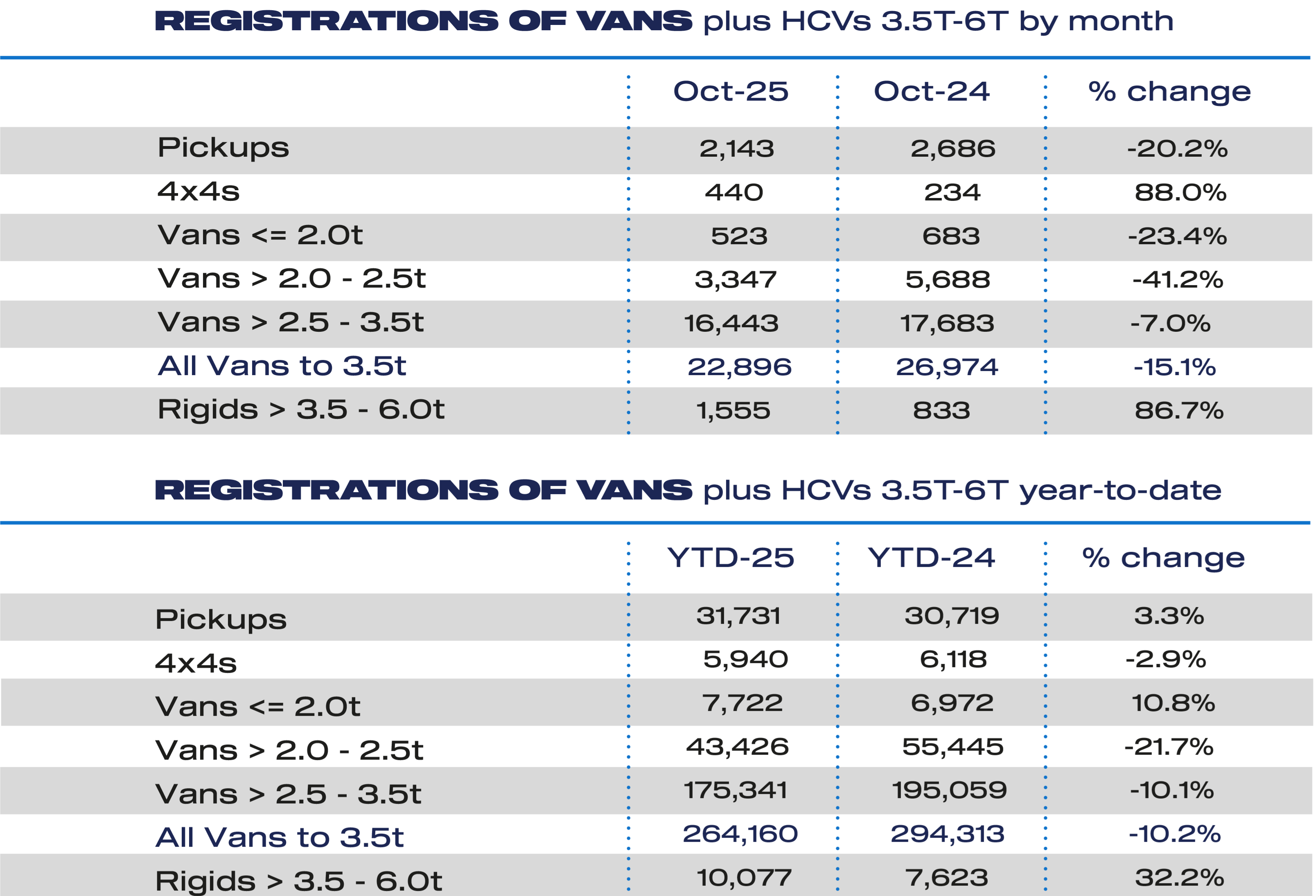

Light commercial vehicle registrations fell by 15% in October compared to the same month last year, according to numbers published this morning by the Society of Motor Manufacturers and Traders (SMMT).

The new LCV market is still yet to recorded a single month of overall sales growth since the turn of the year, with no respite in sight for the industry. The SMMT comments that this is a reflection of “amid weak business confidence and a tough economic environment” for businesses and fleet owners, with declines recorded across all van sizes during the month.

The medium (2.0 to 2.5 tonnes) and large van (2.5 to 3.5 tonnes) segments – typically the most popular van categories with UK buyers – fell by 41% and 7% respectively, while small van (2.0 to 2.5 tonnes) registrations declined by 23%. Pickup sales also shrank by 20% year-on-year, but new 4×4 registrations grew by 88%.

A key indicator of how depressing the month of October was for the LCV industry at large, the all-electric sector also saw a 6% sales fall when compared to October 2024, following several months of record-breaking registration increases and surging demand. Electric vans account for 9% of all sales annually, which is still significantly short of the government’s 16% target.

In year-to-date terms, the overall market is down by about 10%, thanks to sluggish sales for medium and large vans. While the SMMT and other industry lobbyists continue to bang the table for more EV subsidies from the government, this overlooks the fact that diesel van sales are falling (down 43,900 units year-to-date) much faster than electric van sales are growing (up 7,800 units year-to-date).

Good month, bad month

With an overall market decline of 15% compared to last September, most of the market’s biggest sellers suffered. But it wasn’t the same for everyone.

In terms of sales up to 3.5 tonnes, it was a good month for Volkswagen and Toyota – which grew its van sales by 9% and 11% respectively – as well as smaller LCV brands Citroën, Fuso, KGM, Nissan, and Renault Trucks. All of these brands outperformed the overall LCV market by at least 10%. Ford, which hold the biggest share of the new van market by some margin, also outperformed the market at large with sales totals that couldn’t quite match its October 2024 performance.

Meanwhile, things were not as happy for Citroën, Dacia, Fiat, Ineos, Iveco, Peugeot, Maxus, Renault, and Vauxhall. All of these brands underachieved against the overall market by at least 10%.

That means that the following brands were about where you’d expect them to be: Isuzu, Isuzu Trucks, Iveco, MAN, and Mercedes-Benz. All of these brands had results that were within +/- 10% of the overall market.

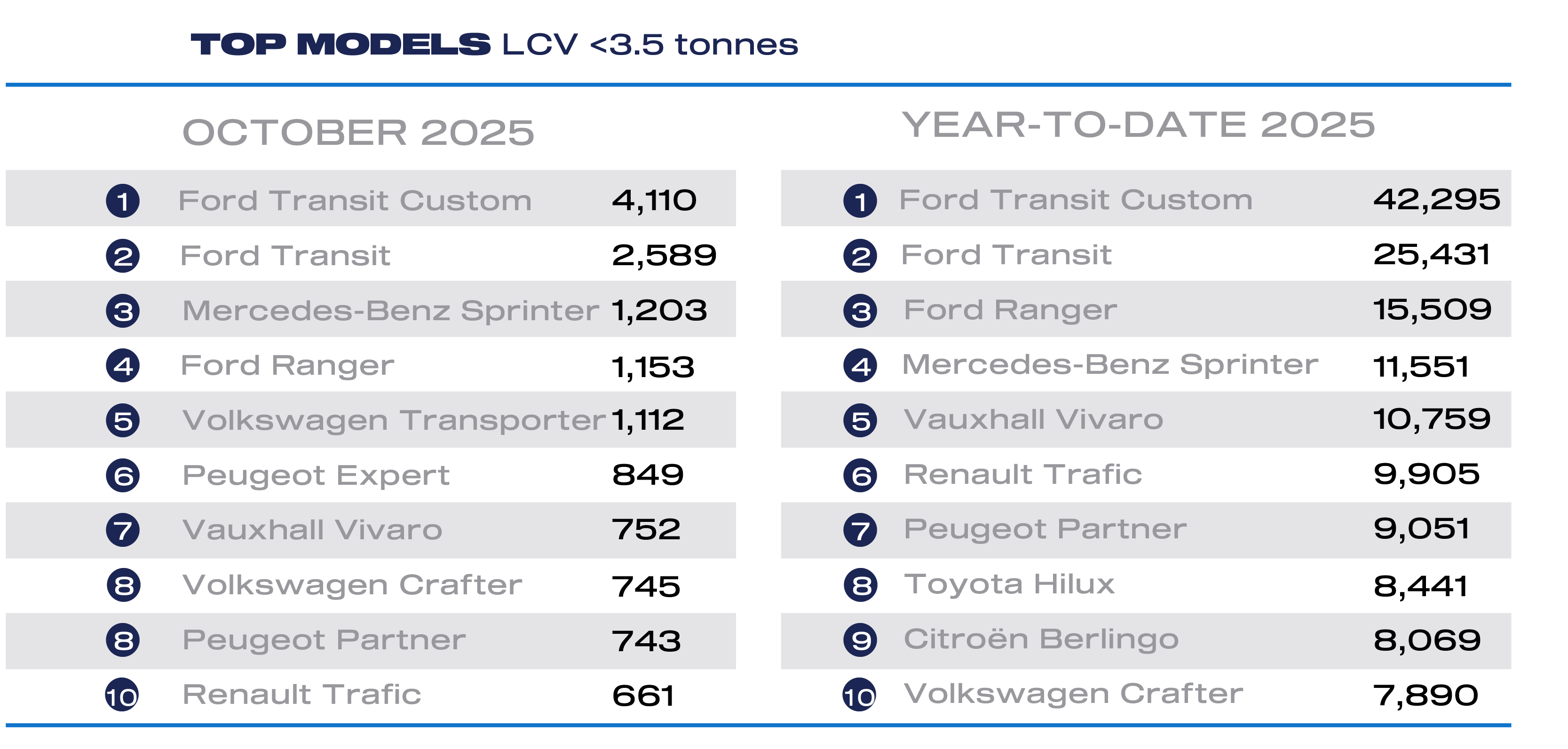

Ford locks down the top two once again

To pretty much no-one’s surprise, the Ford Transit Custom took the sales top spot in October – as it has literally every month of the year to date. The Transit Custom headed the Transit (2nd) and the Ranger (4th), with the Mercedes-Benz Sprinter (3rd) winning last month’s race for best-selling vehicle that’s not a Ford.

Volkswagen’s new generation of Transporter is picking up sales steam (5th), and Stellantis had two flavours of its small van in the top ten, with the Vauxhall Vivaro (7th) and Peugeot Partner (9th) both featuring.

You must be logged in to post a comment.