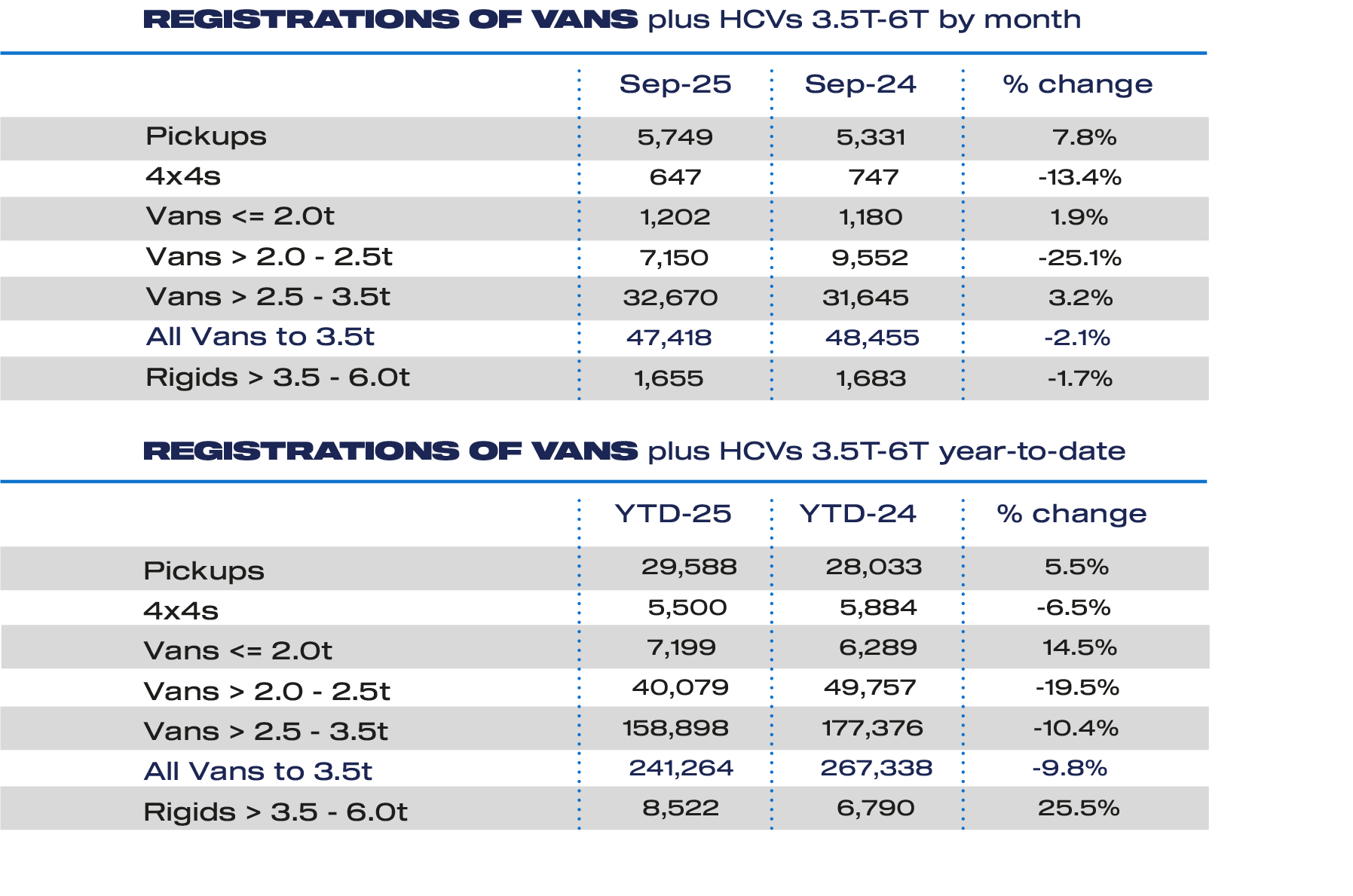

Light commercial vehicle registrations are continuing their downward trend in 2025, according to numbers published this morning by the Society of Motor Manufacturers and Traders (SMMT). Overall numbers were down by 2% compared to the same month last year.

The new LCV market is still yet to recorded a single month of overall sales growth since the turn of the year, with no respite in sight for the industry. The SMMT comments that this is a reflection of “a tough economic environment and weak business confidence”, but adds that last month’s sales performance only narrowly missed out on matching the sales numbers of September last year.

‘New numberplate’ September is traditionally a high-volume registrations month, and last month was no different. Over 47,400 new light vans arrived on British roads, around 1,000 less than September last year.

The pick-up, small van (under 2.0 tonnes) and large van (2.5 to 3.5 tonnes) segments did show improvement year-on-year, but their gains were swallowed up by larger falls in 4×4 and medium van (2.0 to 2.5 tonnes) registrations.

In year-to-date terms, the overall market is down by about 10%, thanks to sluggish sales for mid-size and large vans. While the SMMT and other industry lobbyists continue to bang the table for more EV subsidies from the government, this overlooks the fact that diesel van sales are falling (down 39,400 units year-to-date) much faster than electric van sales are growing (up 7,900 units year-to-date).

While the LCV market suffered at large, it was another record-breaking sales month for the all-electric sector. Batery-powered van uptake surged by 41% to deliver best ever month for volume uptake – nearly 4,300 sales. Electric vans still account for 9% of all sales annually, which is still significantly short of the government’s 16% target.

Good month, bad month

Despite an overall market decline of 2% compared to last September, it wasn’t the same for everyone.

In terms of sales up to 3.5 tonnes, it was a good month for Fuso, MAN, Maxus, Renault Trucks and Toyota. All of these brands outperformed the overall LCV market by at least 10%.

Meanwhile, things were not as happy for Citroën, Dacia, Fiat, Ineos, Isuzu, Isuzu Trucks, KGM, Land Rover, Mercedes-Benz, Nissan, Renault, Vauxhall and Volkswagen. All of these brands underachieved against the overall market by at least 10%.

That means that the following brands were about where you’d expect them to be: Ford, Iveco, Mercedes-Benz and Peugeot. All of these brands had results that were within +/- 10% of the overall market.

As usual, Ford was dominant, and shifted around 1,200 more sales than September last year, while the majority of its rivals recorded lower registrations totals. While Toyota almost doubled its sales year-on-year, the star brand of the month was Maxus, with more than 1,200 additional registrations over the same month last year – a 173% increase. Going the other way was Vauxhall, which registered almost 1,500 fewer vans than last September.

In the much smaller heavy CV market (3.5 to 6.0 tonnes), the overall market was up by 26%. Ford led the market but endured the heaviest sales decline, while a few manufacturers that account for a fraction of the market saw huge sales decreases compared to the same month last year. Maxus heavy CV sales increased by a huge 9,200%, but this simply means they went from one September sale to 93 this September.

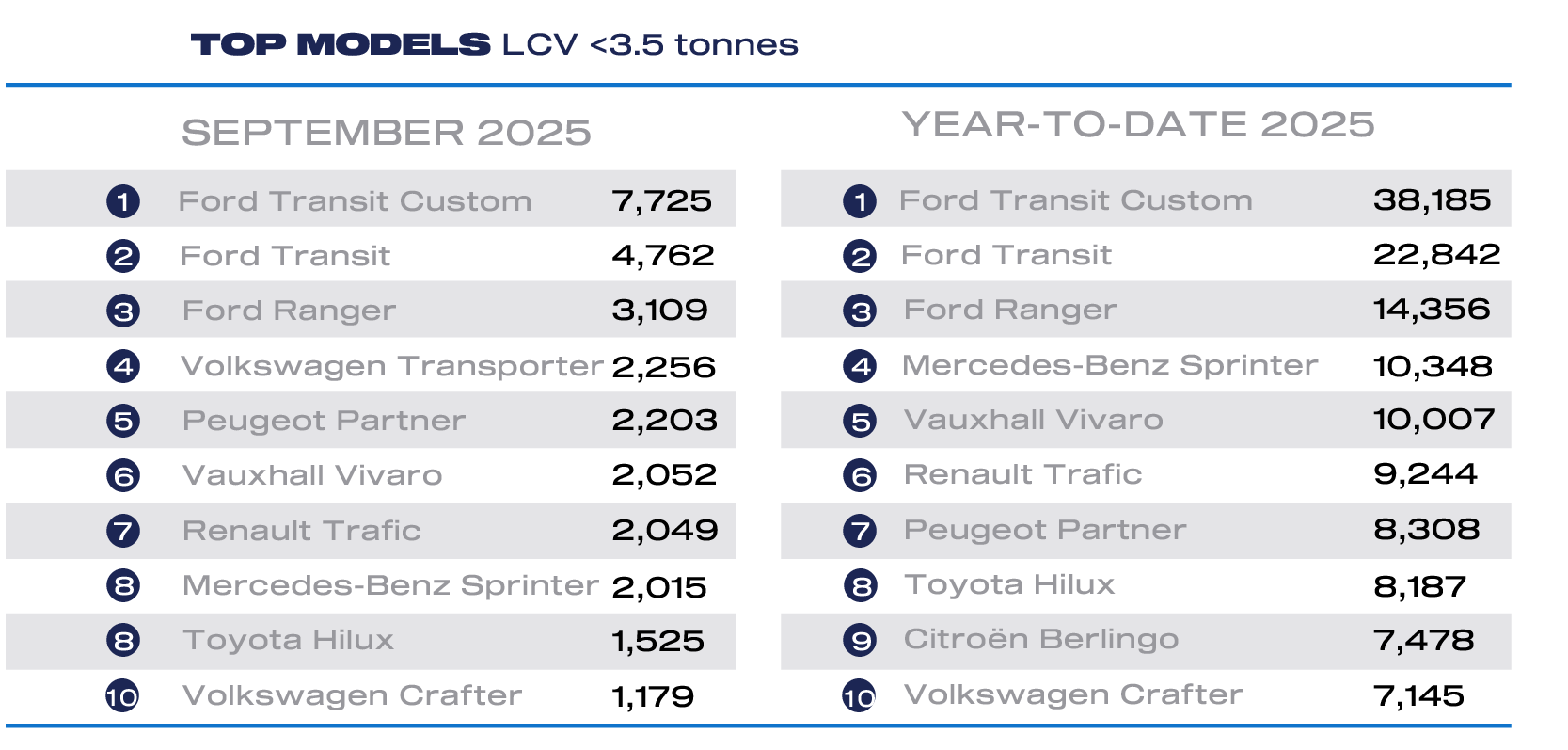

Ford fills out the podium places – again

To pretty much no-one’s surprise, the Ford Transit Custom took the sales top spot in September – as it has literally every month of the year to date. The Transit Custom headed the Transit and the Ranger, with the Mercedes-Benz Sprinter winning last month’s race for best-selling vehicle that’s not a Ford.

Stellantis had three flavours of its small van in the top ten, with the Vauxhall Vivaro (5th), Peugeot Partner (7th) and Citroën Berlingo (9th) all featuring.

You must be logged in to post a comment.